Aave Labs proposes integrating BlackRock’s BUIDL with the GHO Stability Module.

The update aims to enhance capital efficiency and expand real-world asset yield.

BUIDL integration allows 1:1 USDC swaps, monthly dividends, and seamless transactions.

In a move to enhance its stablecoin system, Aave Labs has introduced a new temperature check proposal to update the GHO Stability Module (GSM). This update aims to integrate BUIDL, a tokenized fund managed by BlackRock, into the GSM infrastructure.

The proposal seeks to optimize capital efficiency and expand Aave’s yield sources by leveraging traditional financial assets through blockchain technology.

Optimizing GHO stability with BUIDL integration

The primary goal of Aave Labs’ proposal is to improve the capital efficiency of the GHO Stability Module (GSM) by integrating BlackRock’s BUIDL.

Currently, the GSM ensures the stability of Aave’s native stablecoin, GHO, by maintaining a 1:1 convertibility with another asset, typically USD Coin (USDC). However, in the existing system, surplus USDC often remains idle.

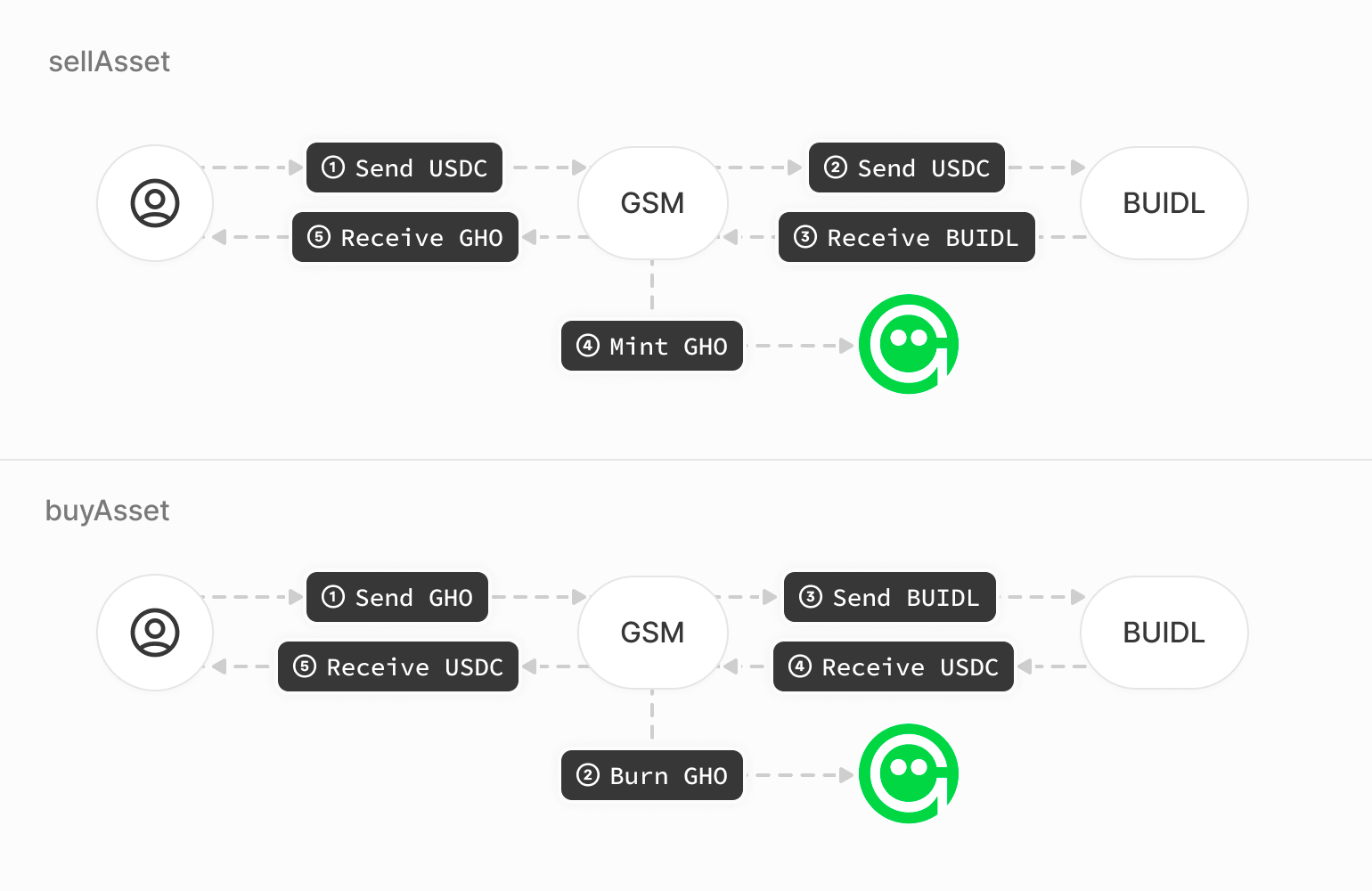

The proposed integration involves building a new instance of the GSM that supports external integrations and control mechanisms, specifically designed to incorporate BlackRock’s BUIDL, a tokenized fund deployed on the Ethereum network representing traditional financial assets like cash and US Treasury bills.

By utilizing surplus USDC to mint BUIDL tokens, the updated GSM aims to enhance its efficiency while maintaining the high standards of backing provided by USDC.

BUIDL offers several advantages, including on-chain access to traditional financial assets, managed by BlackRock Financial Management Inc., with BNY Mellon as custodian and PricewaterhouseCoopers LLP as the fund auditor.

Priced at $1 per token, BUIDL pays daily accrued dividends to holders in the form of new tokens each month. This structure allows holders to earn yield while maintaining flexibility in custody options and the ability to transfer tokens 24 hours, seven days a week throughout the year.

Future prospects and technical specifications of the integration

The integration of BUIDL into the GSM could open new avenues for Aave DAO, potentially expanding yield sources into real-world assets (RWAs) and strengthening partnership opportunities with BlackRock.

The proposal envisions enabling 1:1 fixed-ratio swaps between USDC and GHO, with the surplus USDC being used to mint BUIDL tokens. This setup is designed to provide a seamless experience similar to the existing GHO:USDC GSM, with swap fees accumulating in GHO and dividends paid in BUIDL.

Source: Governance Aave

Technical specifications for this integration include modifications to the GSM contract code to support GHO <> USDC conversions and dividend reception. Additionally, BUIDL holders must be registered or allowlisted, necessitating further adjustments to the GSM itself.

A detailed specification will be provided during the ARFC phase, with the proposal currently in the community feedback stage.

If consensus is reached, it will advance to the Snapshot stage and, if approved, the ARFC stage for final implementation.

The proposal represents a significant step towards integrating traditional financial mechanisms with blockchain technology, potentially enhancing capital efficiency and expanding Aave’s strategic partnerships.

The post Aave Labs proposes to integrate BlackRock’s BUIDL into GHO Stability Module appeared first on CoinJournal.